THE MINING BUSINESS CHALLENGE

The Inca de Oro Project is a joint venture between PanAust Ltd of Australia and Codelco of Chile. It is an open pit copper and gold project, featuring a conventional process plant. The mine is to be located in the Atacama region of Chile. PanAust also owns the nearby Carmen deposit, which has similar metallurgical and geological characteristics.

The rim of the Inca de Oro open pit mine is situated only 500 metres from the nearest occupied building in the local township. As a result, urban air quality criteria is applicable and is critical to the project. Production rates from the mine are limited due to dust generation, particularly from in-pit haulage. Due to its distance from the township, the Carmen deposit could potentially keep the plant running at capacity, whilst keeping dust emissions within regulatory limits. Blast intensity and resultant vibration are also constrained due to the township proximity.

Whittle Consulting was engaged to assist PanAust to realise the potential of the Inca de Oro project. A Whittle Enterprise Optimisation study was conducted to optimise Net Present Value (NPV). Specifically, Whittle Consulting was engaged to evaluate options around plant sizing, plant expansion timing, capital staging, scheduling, grind size selection, blasting intensity selection and the impact of the Carmen deposit.

THE WHITTLE CONSULTING SOLUTION

The first step involved Whittle Consulting working with PanAust personnel to define a base case from the existing mine plans and financial models. Using the application of advanced analytical techniques and using proprietary Whittle Enterprise Optimisation software (Prober-E), PanAust and Whittle Consulting models were aligned before optimisation mechanisms were applied.

In consultation with PanAust, Whittle Consulting then carried out an Activity Based Costing (ABC) of processing and mining costs. Each cost item was carefully scrutinised to determine the cost drivers and if they were either fixed or variable. Due to the importance of dust emissions, Whittle Consulting also integrated existing mining cost and dust emissions models. The result was a model that could simultaneously capture dynamic variables like distance, depth and dust emissions. Importantly, the optimised model could calculate and constrain overall dust emissions – replacing the mining proxy limit for dust.

Calculations relating to other environmental constraints such as blast intensity were also undertaken. Throughput optimisation was conducted using two Enterprise Optimisation mechanisms namely; determining the optimal blast intensity and determining the optimal grind size. Armed with the knowledge and flexibility of blasting at different intensities and processing at different grind sizes, Whittle Consulting’s proprietary software, Prober-E, was able to harness both the power and material handling limits to capacity – thereby maximising throughput. This meant that all activities were maximised to meet the dust emissions limit in almost every year of operation.

The Whittle Enterprise Optimisation study also considered other scenarios including:

• Different plant sizes, including and excluding the Carmen resource

• Staging of development expenditure through two plant modules

• Capital expenditure timing

• Various scenarios moderating blasting and grind size strategies.

THE RESULTS

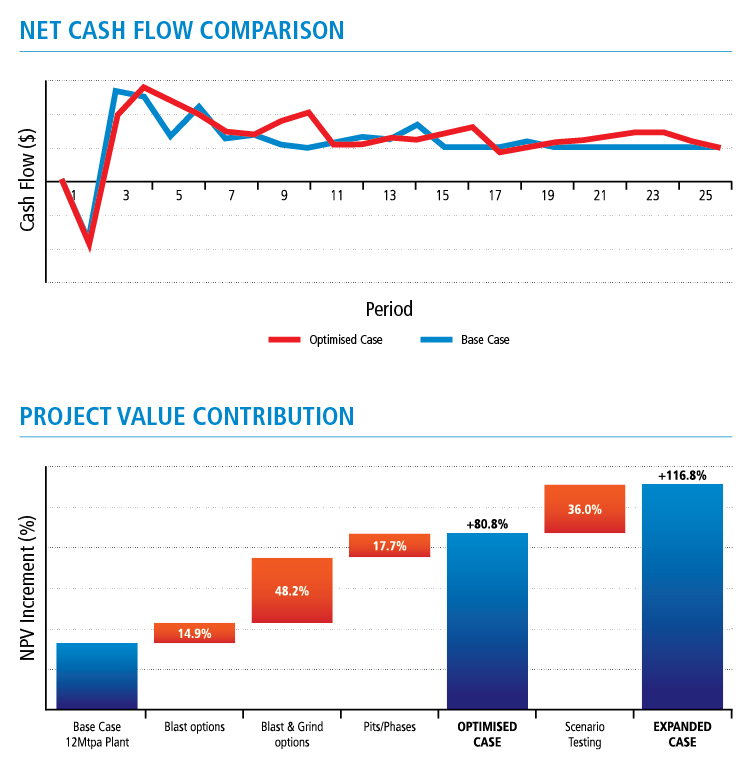

The results of the Whittle Consulting Enterprise Optimisation study for the Inca de Oro project were financially significant. The study unified all available information into a single holistic strategic business model. This model provides ongoing support for future strategic planning, as updated model inputs can easily be incorporated to generate new mine and production plans to maximise business value. The end result was the identification of significant, unlocked hidden value for Inca de Oro into the future.

The Whittle Consulting Enterprise Optimisation study determined:

• The new techniques and optimisation mechanisms produced an 80.8% overall increase in pre-tax NPV, above that of PanAust’s best business case, and 116.8% increase in NPV for an expanded case, including the Carmen deposit.

• A range of blast options allowed the optimiser to modify blasting options with regard to powder factor and grid pattern, within the context of dust and other limits.

• Combining blast and variable grind size options enabled the optimiser to simultaneously balance dust and blast/grinding costs, depending on feed material.

• Pit and phase shapes could all be optimised for the above mechanisms.

• PanAust had ongoing access to a range of practical mine plans which revealed the sensitivity of “flexing” certain variables.