THE MINING BUSINESS CHALLENGE

The Platreef project is situated on the northern limb of South Africa’s Bushveld Complex. The planned mine is a large-scale mechanised underground platinum group metal (PGM) and base metals mine. The site is under development by Ivanhoe Mines, in conjunction with many other partners and stakeholders. Those involved include local employees and beneficiaries in the Mokopane locality, South African entrepreneurs as well as Japanese investors.

During the prefeasibility study phase, Whittle Consulting was engaged to undertake a commercially-orientated review of the prefeasibility study designs and cost estimates. This analysis was simultaneously followed by a value chain optimisation and sustainability study.

THE WHITTLE CONSULTING SOLUTION

With the assistance of Platreef project teams, Whittle Consulting collected resource model operational test work and study information. Particular emphasis was placed on mining zone shapes, cut-off grades and annual mining schedules. This was incorporated into a single business model for input into Prober-E optimisation software. An activity-based costing (ABC) model was set up. Theory of Constraints (TOC) was then applied to the ABC model by allocating all period and sustained capital costs for the entire operation to the overall bottleneck in the system. This was identified as the availability of power for milling. A base case optimisation was then prepared using Whittle Consulting Proprietary Prober-E software.

A genetic algorithm was used to control hundreds of Prober-E optimisations to determine the right combination of cut-off and designs across various zones in the orebody. This alone contributed significantly to the overall improvement in NPV.

During the review, mining and milling/flotation mechanisms were tested, along with a review of cut-off grade policy. Using Prober-E, new zone shapes were created, facilitating the development of updated mining and processing schedules. Various combinations of size and start dates of mine shafts and concentrator modules were also tested. Sensitivity studies to changes in metal prices and optimisation runs to determine the impact of social costs, project delays, water and electricity consumption were calculated. Over a seven-month period, Whittle Consulting conducted over 150 Prober-E runs.

The Whittle Consulting review ensured that any potential uplifts were identified and quantified. The optimisation work included the whole of the value chain – from the identification of the resource in the ground through to the sale of the final metal products in the marketplace. Whittle Consulting provided valuable strategic advice to the owners and management team, guiding their long-term planning decisions in the important early phase of the Platreef project.

THE RESULTS

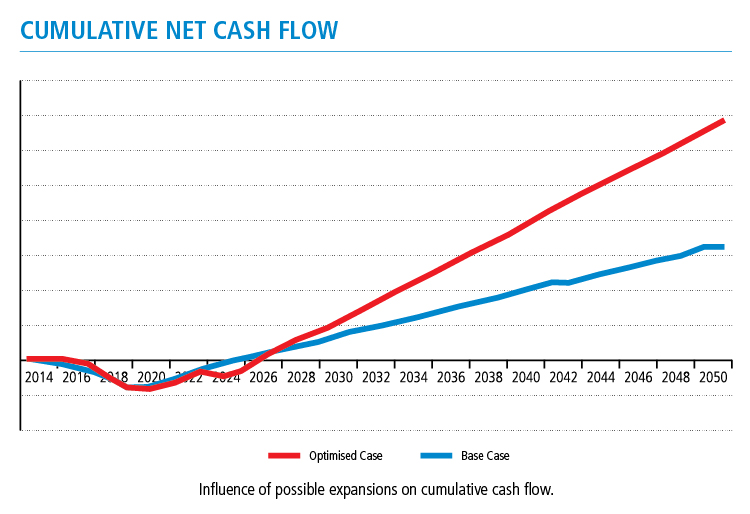

Due to the sensitive nature of the revised financial forecasts for the Platreef project, only general results can be provided. However, the results of the Whittle Consulting study were financially significant. These results clearly demonstrated how the Whittle Integrated Strategic Planning Process can enable enhanced long-term planning decisions, significantly increasing the NPV of the Ivanhoe Platreef mine.

The Whittle Consulting Enterprise Optimisation Study and Sustainability Evaluation determined:

• The location of the most profitable ore body in the Plantreef site.

• An optimised scheduling model, with distinct cut-off values defined for each zone.

• Revenue and cash flow were brought forward due to enhanced scheduling, cut-off grades and stockpiling optimisation.

• By the utilisation of dynamic grind and mass pull to flotation concentrate, resource recovery during processing could be enhanced.

• The identification of natural capital initiatives with potential to reduce electricity and water consumption.

• How the introduction of mining and backfilling practices could increase utilisation of resources in each zone.

• How consideration of different sizes and configurations of mining and processing operations could enhance NPV during the pre-feasibility study phase.

• Identification of methods to reduce peak funding requirements and increase net cash generation.