THE MINING BUSINESS CHALLENGE

Condor Gold’s La India project in Nicaragua had stalled following unimpressive results from the technical studies used in the NI 43-101 compliant Pre-feasibility Study (PFS) & Preliminary Economics Assessments (PEA).

These studies outlined three potential development scenarios: a mining project solely focussed on an open pit at La India, a mining project centred on La India but incorporating satellite pits, and a project incorporating both open pit and underground mines.

Whittle Consulting was commissioned to investigate strategic options to optimise the mine schedules designed to improve the economics of La India projects.

THE WHITTLE CONSULTING SOLUTION

The Whittle Integrated Strategic Planning Process involves the application of advanced analytical techniques using the proprietary Whittle Enterprise Optimisation software (Prober-E), to construct a model of the operation from the ore bodies through to the market with a view to maximising a project’s (or mine’s) NPV.

Modelling techniques are comprehensive, capturing and harnessing the client’s information on geology, geotechnical, mining engineering, process engineering and metallurgy, finance and marketing, to create an Integrated Enterprise Optimisation Model. The model is used to direct pit and phase optimisation or as a basis for underground mine design, and to develop all-of-mine business plans which identify the optimal operating configuration for the scenario presented. The result is a unique capability that can resolve planning issues beyond the scope of available packaged planning software and conventional techniques.

The process enabled the Whittle Consulting team to construct a base model for the La India project using the reserves/resources and technical studies (PFS/PEA) available from the client.

Four production scenarios were assessed with further validation for each case developed to create the optimised schedule through variable cut-off grade, stockpile capacity, grind-throughput-recovery, multi-mine scheduling and optimised pit and phasing. The power of the Whittle Consulting Prober-E software meant the project took under 3 months to complete with more than 100 strategic scenarios modelled for the total mine enterprise.

“The ability to manipulate multiple business levers across the project, and to model these impacts on value, lead to significant improvements in the projects viability and profitability,” according to Richard Peevers, Regional Manager North America for Whittle Consulting.

THE RESULTS

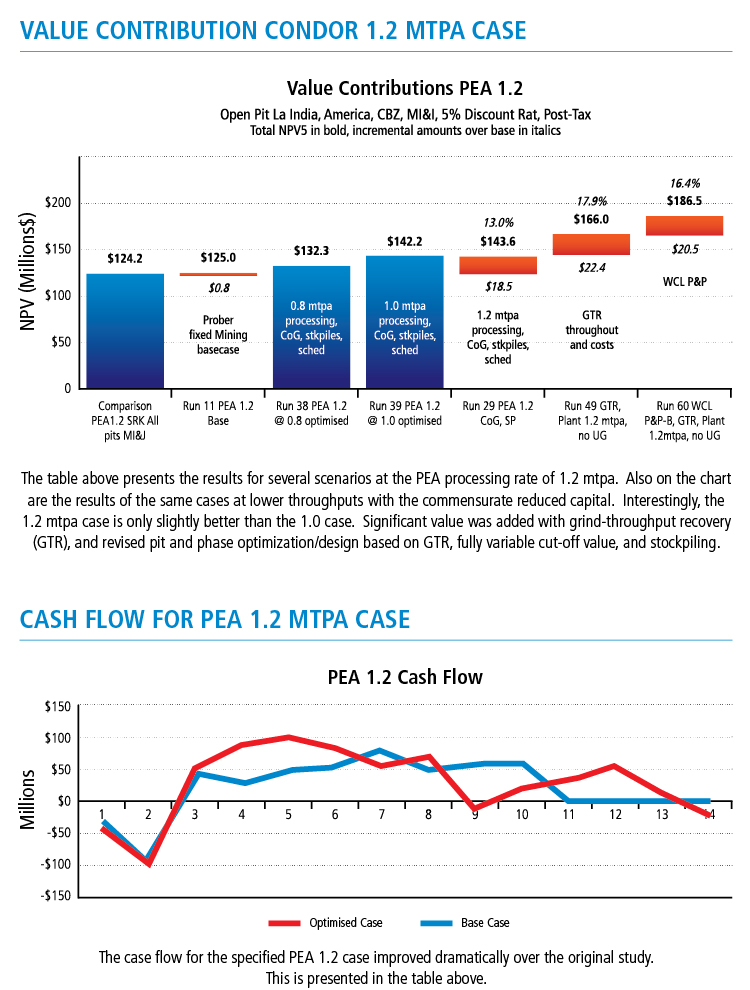

Overall, the independent optimisation analysis conducted by Whittle Consulting clearly demonstrated the potential to unlock substantial additional value from the La India project.

The Whittle Consulting Enterprise Optimisation study determined:

• An NPV increase of over 50%.

• An IRR average of 30%.

• The payback on upfront capital costs between 2 to 3 production years.

• Gold production increased on average 22% for the first 5 years.

• All in all, sustaining cash costs remained under US$700 per oz gold.

By demonstrating increased value across all four production scenarios, following the Whittle Consulting Enterprise Optimisation process, the Condor Gold share price increased with a renewed confidence in the quality of the La India asset. Notwithstanding the share price increase, the Whittle project has also provided Condor Gold with several potentially positive outcomes. At the time of writing, Condor Gold was in an offer period, considering all options including a sale of the company or joint venture deal in a strategic review of its direction.