THE MINING BUSINESS CHALLENGE

The Anglo Platinum Mogalakwena mining operation is situated in the Limpopo province in South Africa. The Mogalakwena platinum group metal (PGM) mine opened in 1991. It has the potential to mine ore from 5 – 7 pits for at least the next 35 years. The Platreef, which is richer in base metals in comparison with other PGM mines, outcrops along the entire length of the lease. Two separate processing plants, with a combined milling capacity of around 11.4 million tonnes per annum operate on the site.

Whittle Consulting was appointed to implement an Enterprise Optimisation Study (EO) in August 2010. The major objectives were:

• To facilitate the deferral or minimisation of capital expenditure for the next 3 to 5 years.

• To evaluate the merits of several alternative operating strategies. This included variable versus capped mining rates, strategic stockpiling of low grade ore, deferral of waste stripping where possible, (but with smaller short-term pit phases to access higher grade ore earlier) and consideration of several concentrator upgrade or expansion strategies.

• To determine the optimal mining rate, matching the current concentrator capacity.

• To establish the optimum dynamic mining and concentrator processing rates, matching current smelter and refinery capacity constraints.

• To establish the optimal production rate for Mogalakwena. This should take into account the latest ore resource data, applying current cost estimates for possible mine, concentrator and downstream process plant expansions.

THE WHITTLE CONSULTING SOLUTION

The project was carried out by Whittle Consulting in three sequential phases between September 2010 and February 2011. The exercise commenced with a half-day training seminar and onsite kick-off meeting. Data collection commenced immediately afterwards. The existing resource block model was utilised. This was supplemented by operational data from every section of the operation including geological, mining, processing, operating cost, capital cost and general commercial information. This was collated in a single business model for the whole enterprise, which was used with the block model data and the mine’s current pit shell and phase designs.

Using Whittle Consulting’s proprietary software (Prober), a base case optimisation run was prepared. This base case was closely compared to the current Mogalakwena business plan to ensure that all costs, revenues and operating parameters, particularly capacity limits at each stage of the value chain, had been correctly captured. Potential net present value improvements were then measured against the base case.

The 3 mining mechanisms, (scheduling, dynamic cut-off grade and strategic stockpiling) were tested sequentially to determine their potential benefits. Whittle Consulting then applied Gemcom Whittle Four-X software to prepare revised pit shells and phases with low initial stripping ratios, finer early phases and quicker access to high grade ore pockets. The 3 mining mechanisms were then reapplied, based on the revised pit designs. A simultaneous optimisation was then activated with all the mining mechanisms turned on. Dynamic mining rates were tested by specifying the purchase cost, operational life and capacity of additional mining equipment. Phase 1 of the exercise was concluded by using the optimiser to determine how much additional mining capacity would be optimal for the Mogalakwena operation.

Updated commercial data was incorporated in Phases 2 and 3. This modelled the various modified concentrator operating practices under consideration. It also utilised a modified resource block model provided by the operation. This investigated the likely impact of a possible expansion of concentrator, smelter and refinery processing facilities. The modelling process also ensured that production was able to be maintained between defined limits each year, to prevent major in-process inventory swings from year to year.

THE RESULTS

In the case of Anglo Platinum Mogalakwena, over 70 individual optimisation runs were conducted by Whittle Consulting. The output of each Prober optimisation run consisted of over 50 tables and approximately 70 charts. After each run, the main results were analysed and updated for subsequent runs.

This level of analysis ensured a highly-detailed familiarity with all the operational and commercial data. This enabled all of the scenarios to be studied and provided a consolidated set of guidelines for the current operation and for use in future business planning.

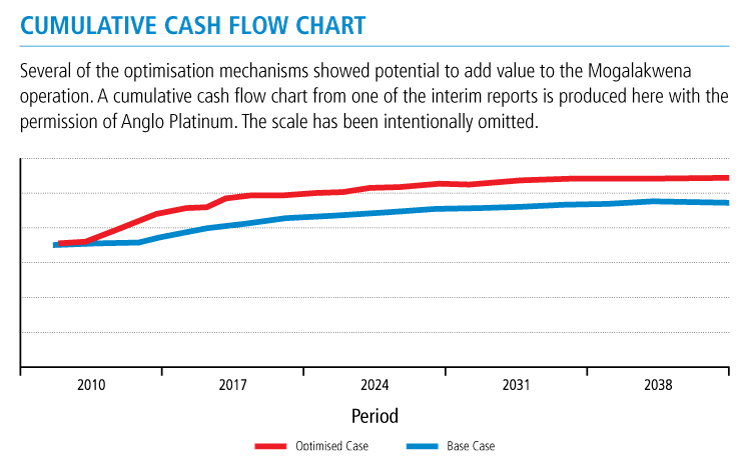

Due to the sensitive nature of the revised financial and business forecasts for the Anglo Platinum Mogalakwena mining operation, only general results can be provided. However, the results of the Whittle Consulting project were financially significant.

Whittle Consulting determined:

• The potential to add significant value to the Mogalakwena operation.

• Options to facilitate the deferral or minimisation of capital expenditure for the next 3 to 5 years.

• Evaluation of the merits of several alternative operating strategies. This included variable versus capped mining rates, strategic stockpiling of low grade ore, deferral of waste stripping where possible – but with smaller short-term pit phases to access higher grade ore earlier and consideration of several concentrator upgrade or expansion strategies.

• The optimal mining rate, matching the current concentrator capacity.

• The optimum dynamic mining and concentrator processing rates, matching current smelter and refinery capacity constraints.

• The optimal production rate for Mogalakwena, taking into account the latest ore resource data and applying current cost estimates for possible mine, concentrator and downstream process plant expansions.