Maximise your mine’s potential

Integrated Strategic Planning for the mining industry

A big picture approach

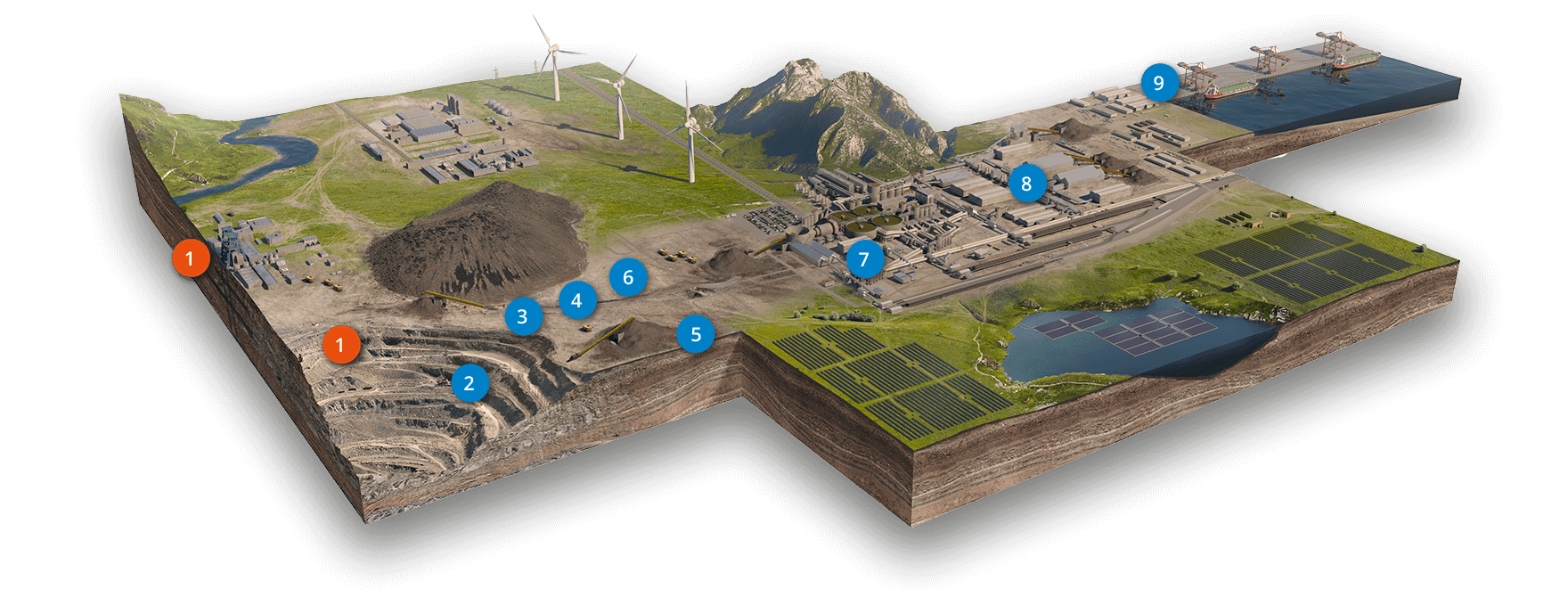

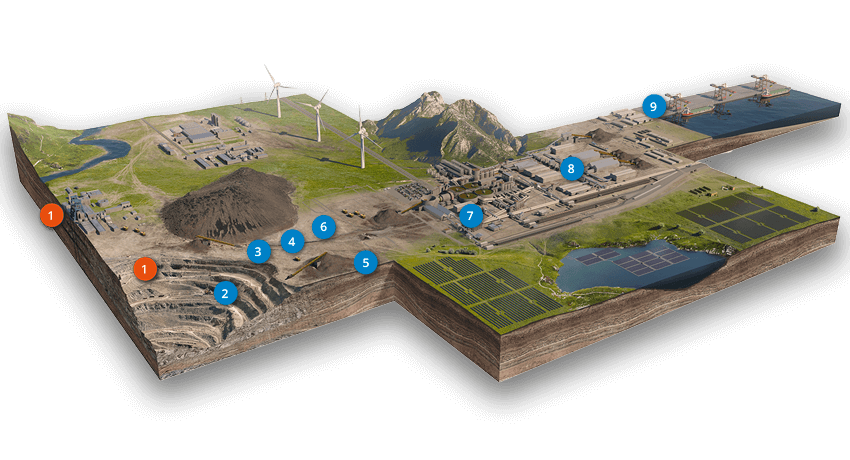

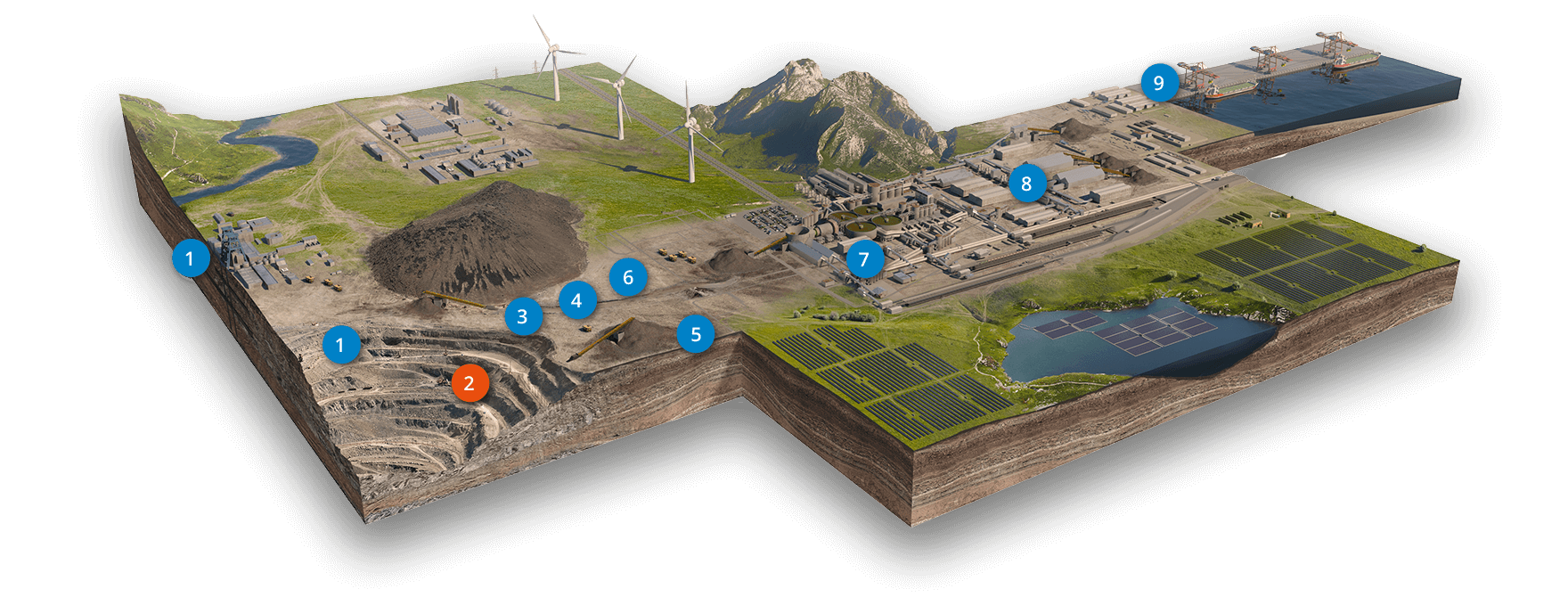

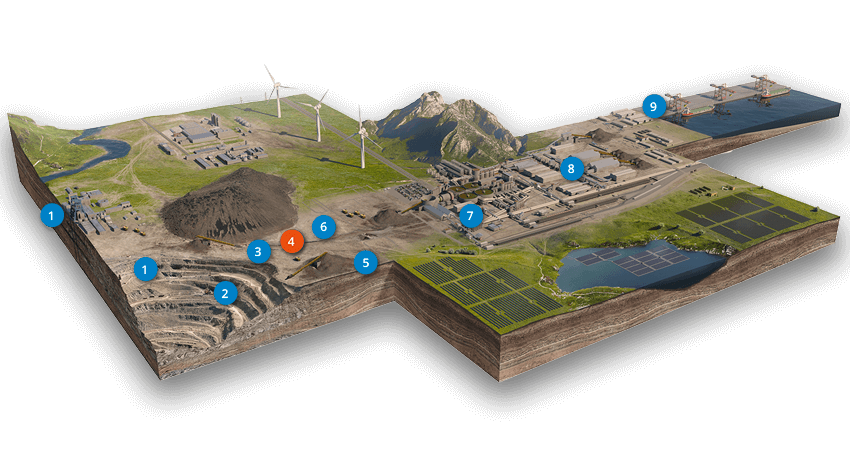

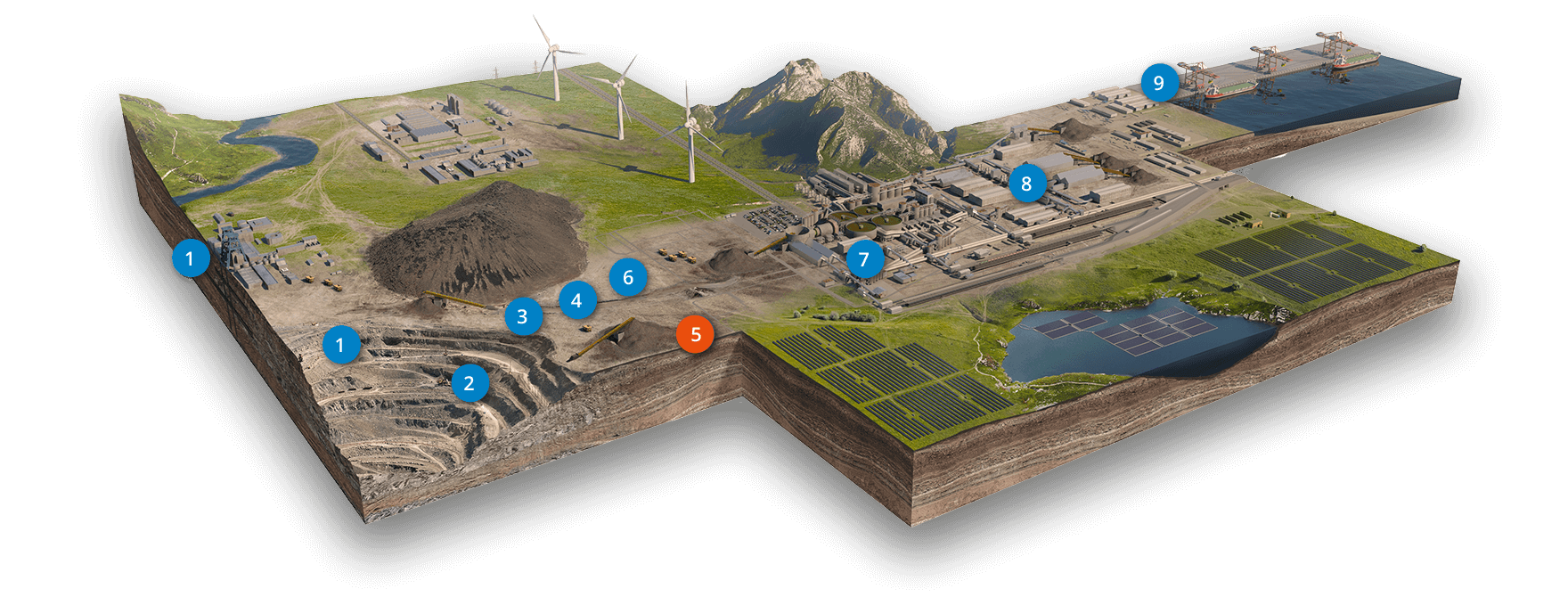

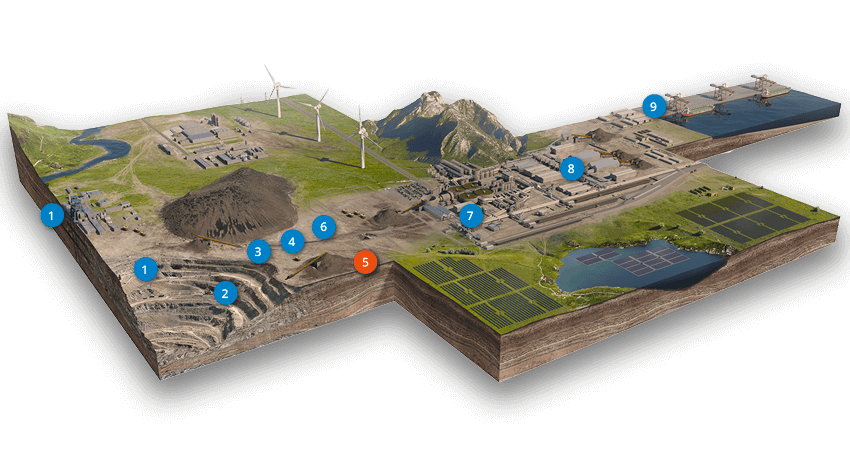

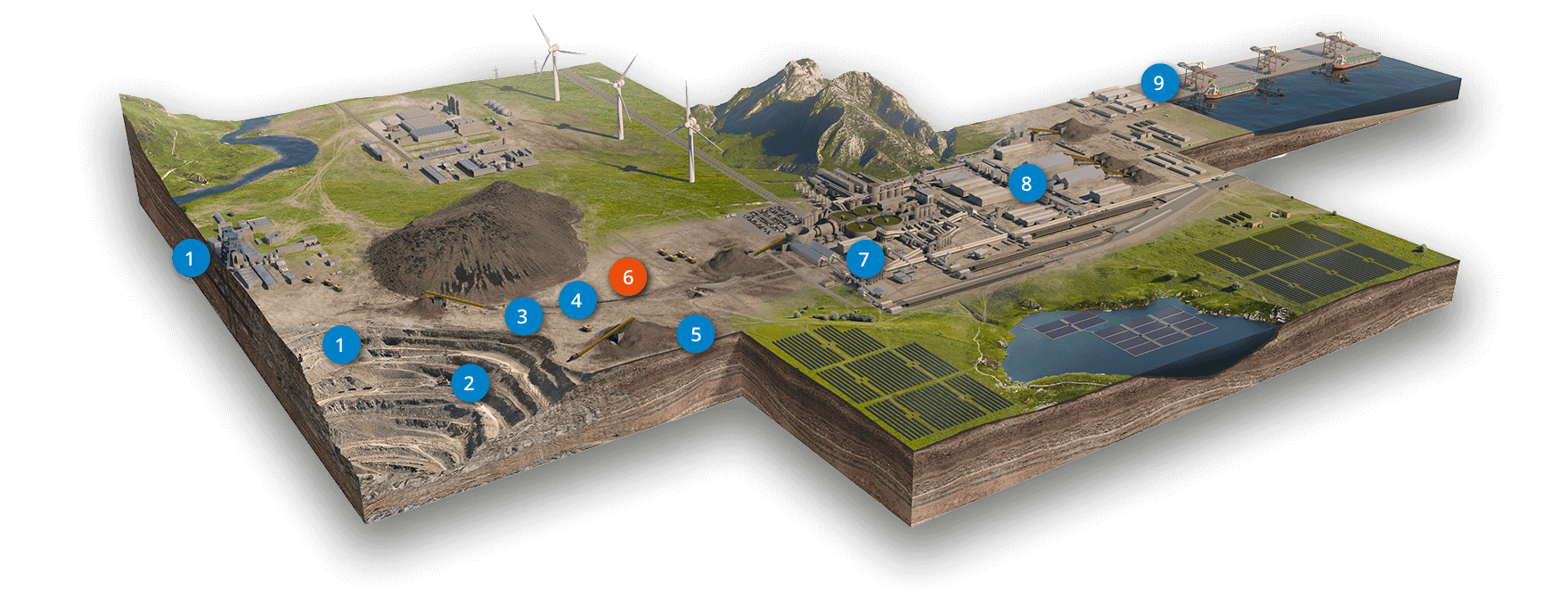

Integrated Strategic Planning is a concept of long-term planning which considers:

All parts of the value chain

From the mineral resource to the market.

All periods

What to mine, and process, in one period affects the options for the other periods.

All stakeholders

Shareholders are interested in financial returns. However, the interests of employees, local communities, government and the environment must be considered to earn an enduring licence to operate.

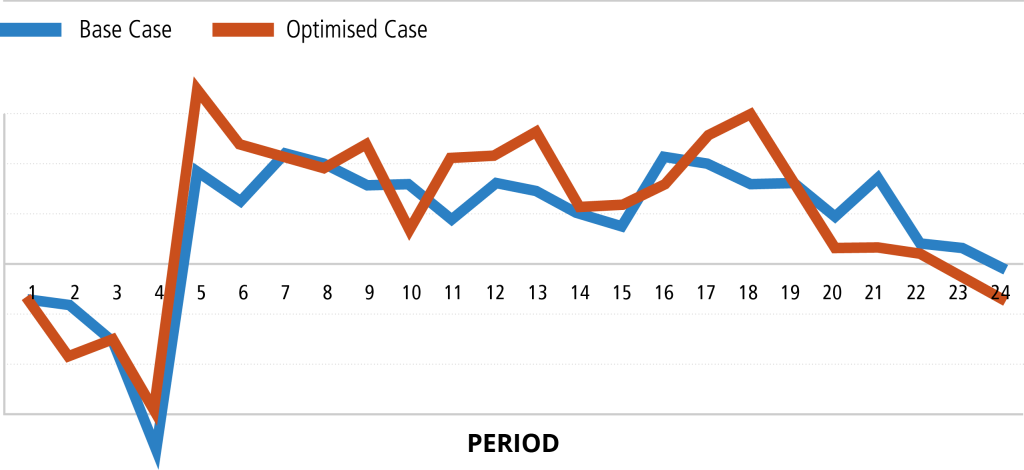

Improve cash flow & capital

Whittle Integrated Strategic Planning is a comprehensive long-term plan for mining operations or individual mining projects.

Whittle Consulting employs this unique Integrated Strategic Planning approach to conduct a Whittle Enterprise Optimisation which simultaneously factors in all parts of the mining system to improve cash flow and capital growth.

The video is presented in English with English subtitles.

Other languages. The video is also available with Spanish, Portuguese & Indonesian subtitles.

What's in it for you?

Maximise potential

Increase your Net Present Value by 5%-35% and in many cases, substantially more.

Break down silos

Cross-functional collaboration has everyone working to the same goals .

Bottleneck analysis

Identify and optimise bottlenecks in the system.

Sustainability

Achieve Social License to Operate and improve economic, environmental and social outcomes.

Whole-of-mine optimisation

Create synergy in your mining system through simultaneously optimising the whole value chain.

Increase overall cash flow

Copper Project: 59% NPV increase

Start by attending a seminar

Discover the mechanisms to enhance mine valuation for open pit and underground mining projects and operations.

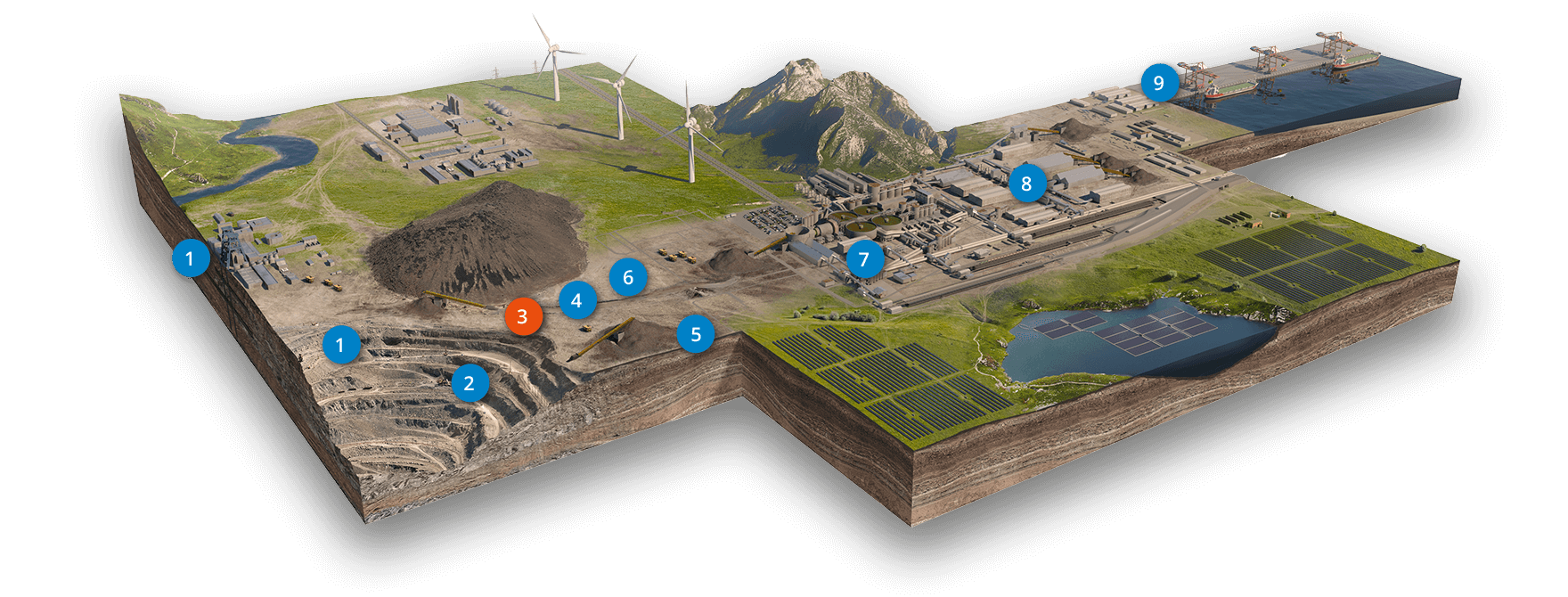

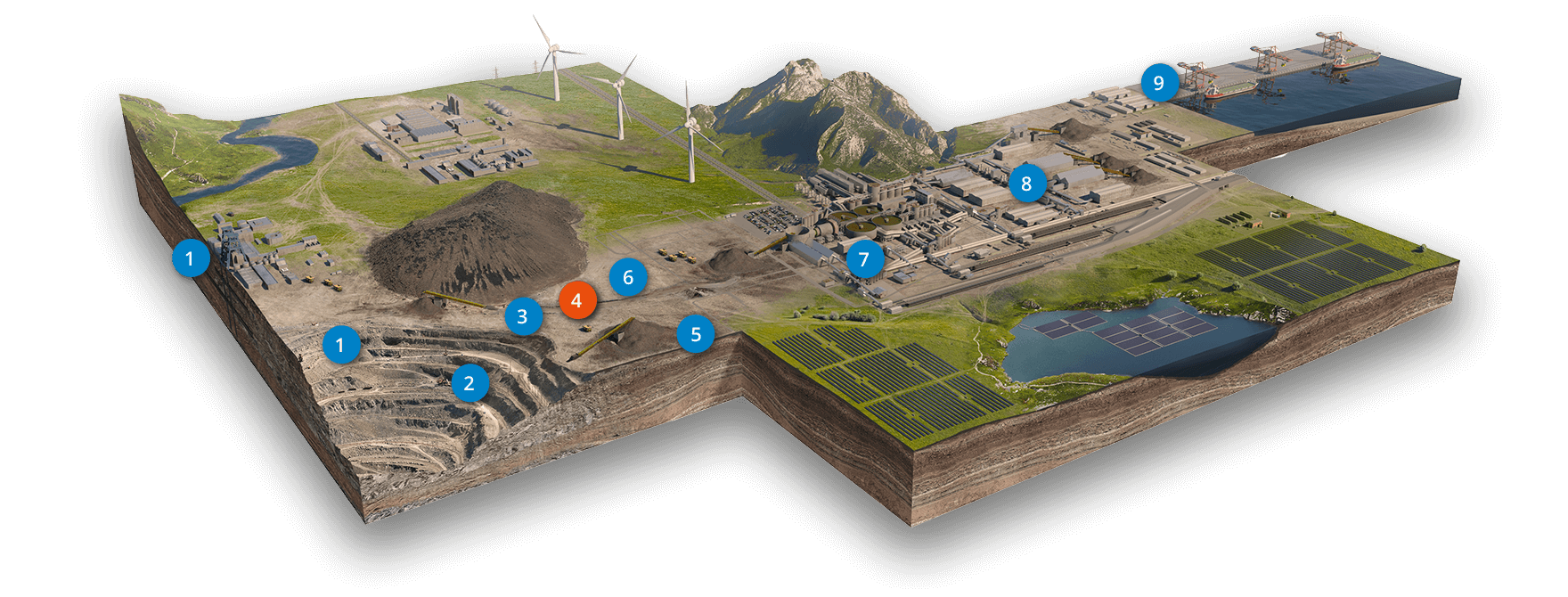

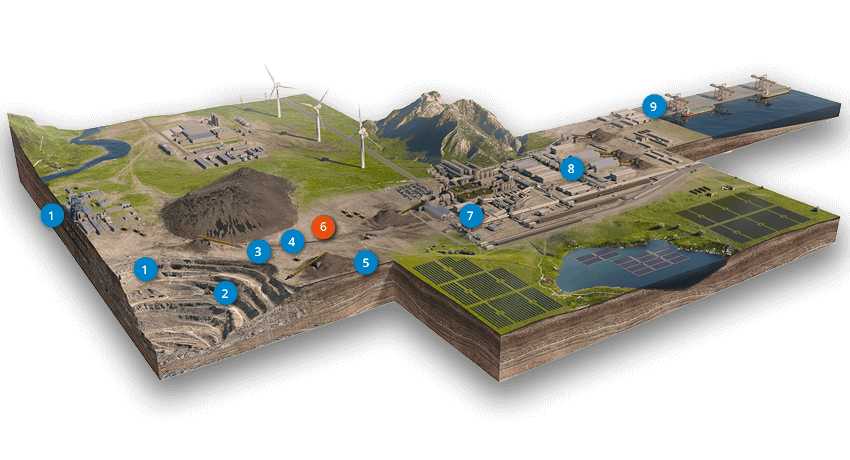

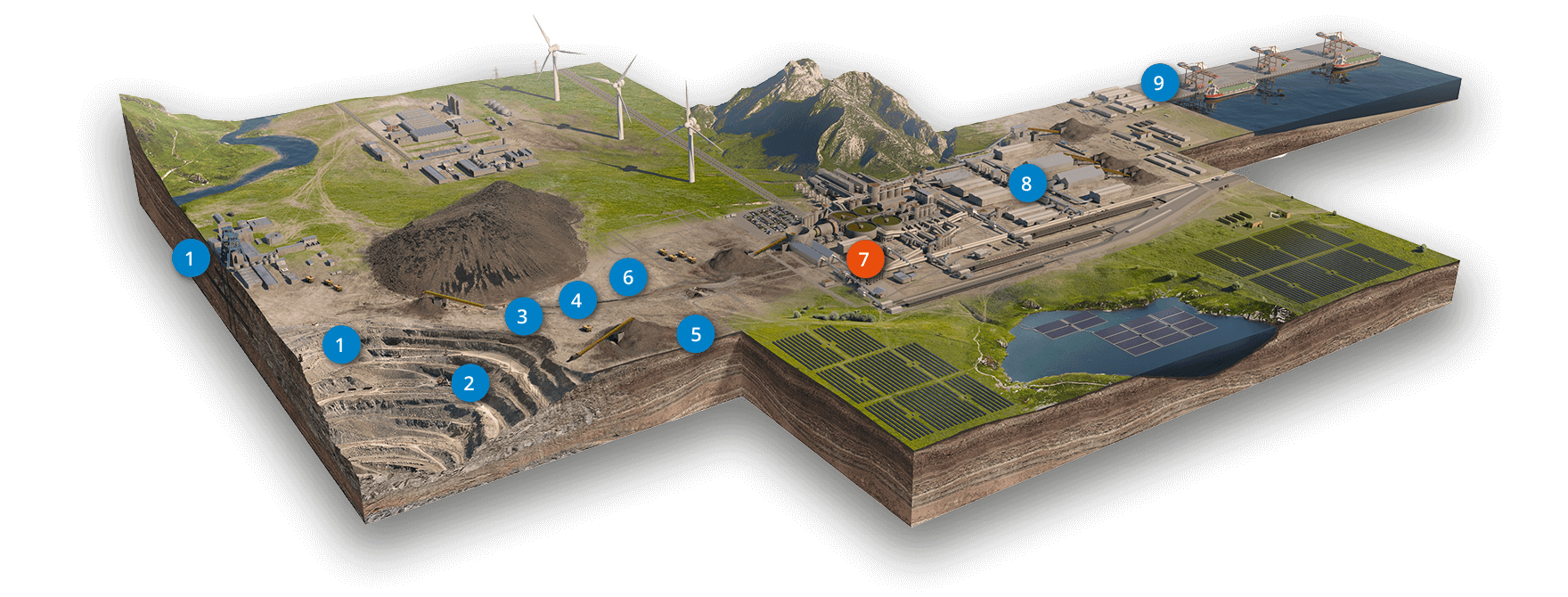

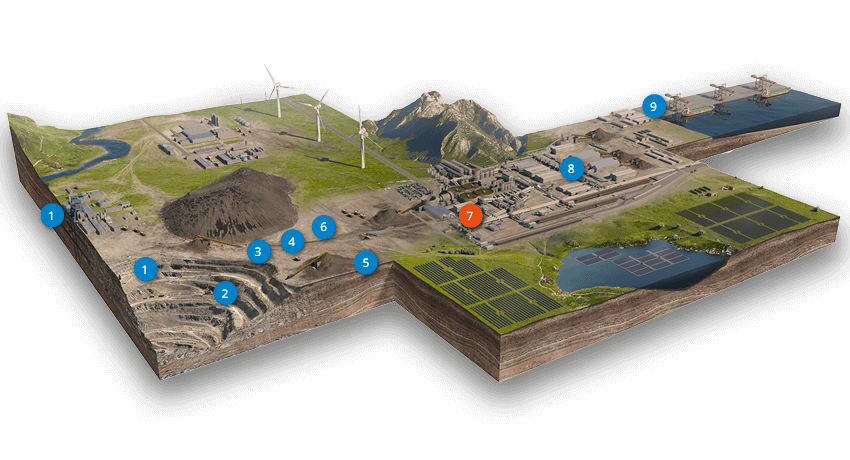

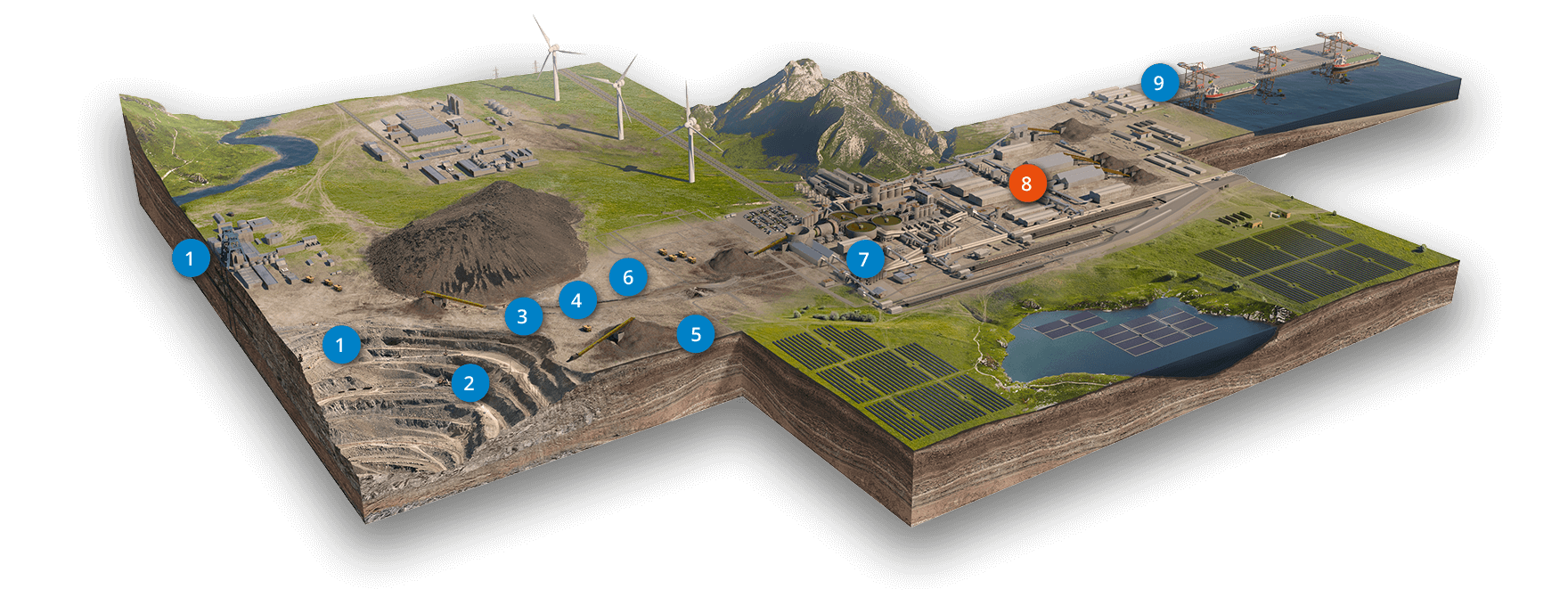

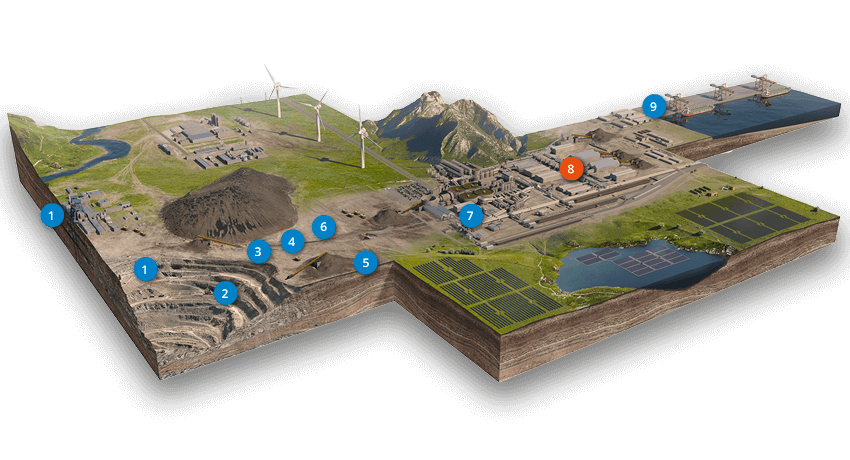

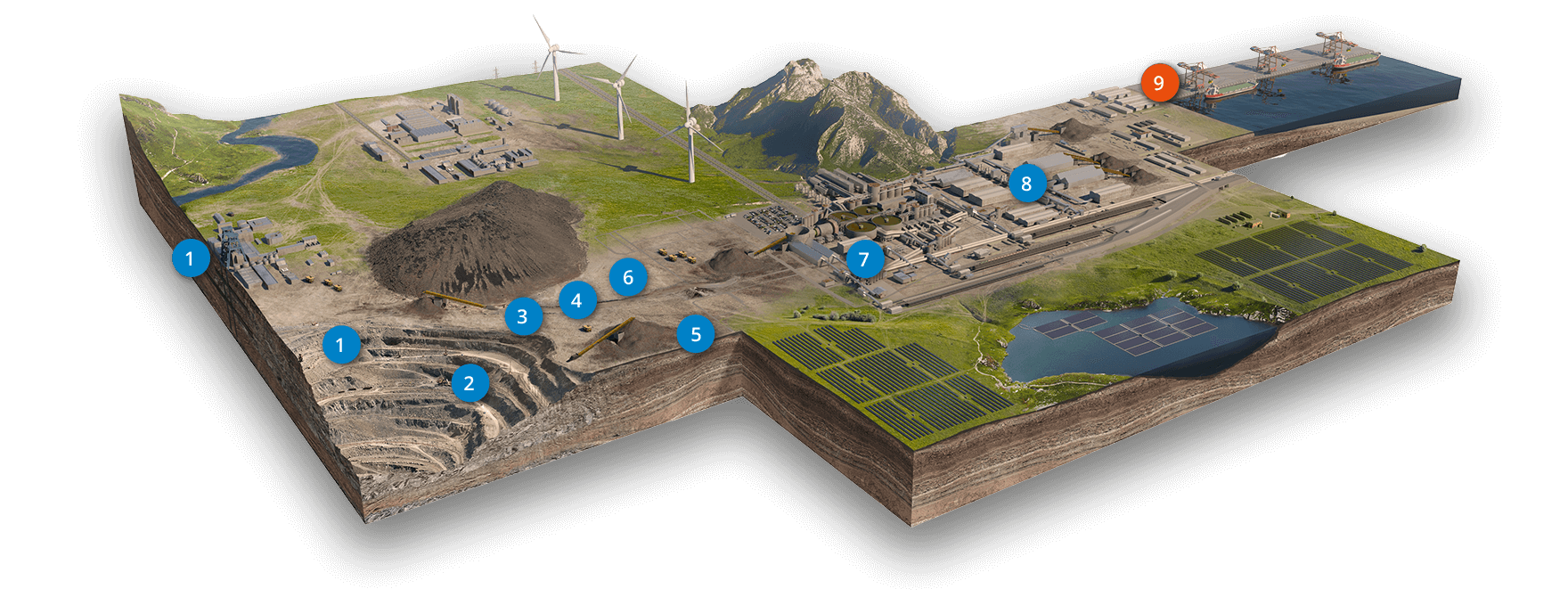

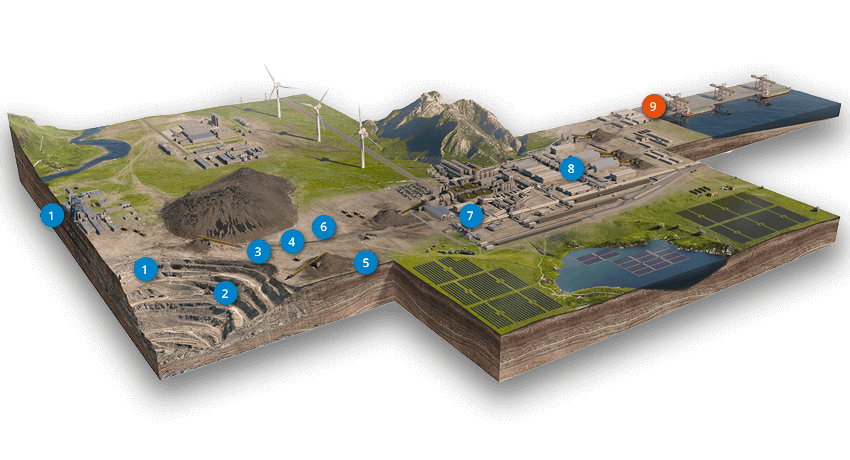

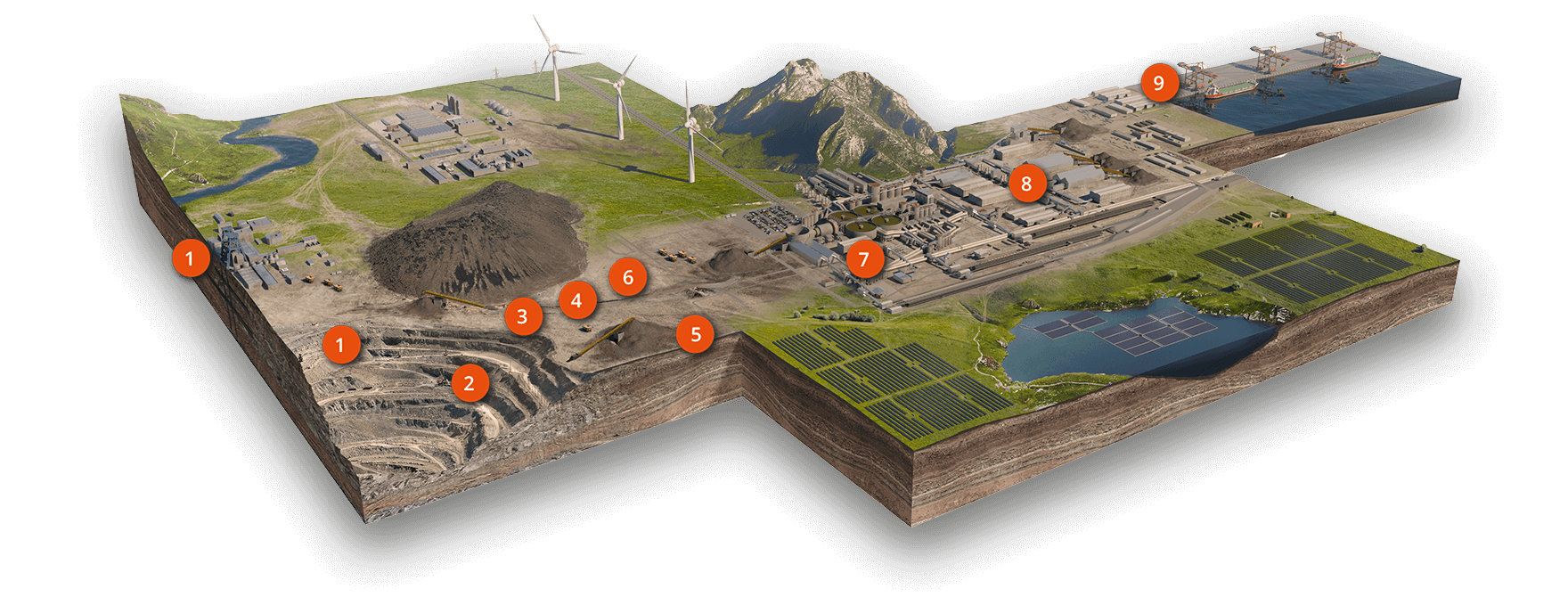

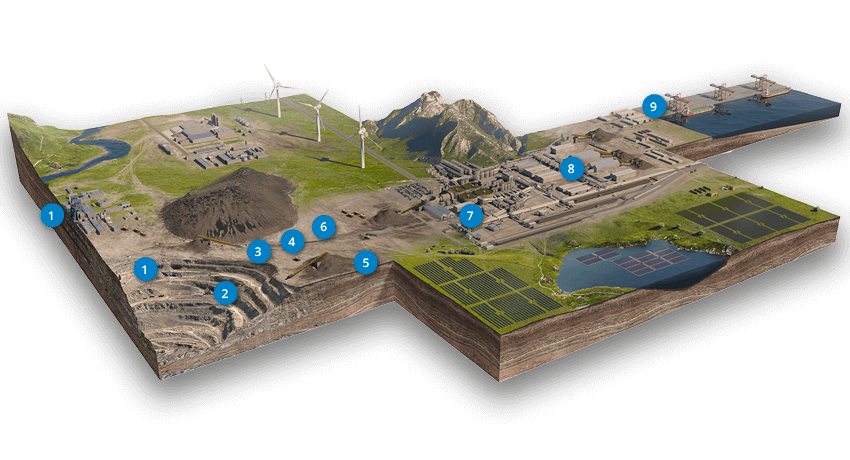

Whittle Enterprise Optimisation Model

The Whittle Enterprise Optimisation model consolidates the existing knowledge and data from disparate mining systems into a single integrated model.

The model can be revisited at any time to understand changes in the ore body, process, costs or market to achieve true strategic agility.

The 10 Steps of a Whittle Enterprise Optimisation Model

1

Pit/Underground

Based on a “Net Value” view of the orebody and what waste stripping or development is required. Consider what should be in or out of the mine design to maximise value.

2

Phases

Optimising the pushback design to provide early access to high-value material and defer waste/development costs.

3

Mine Schedule

The sequence and rate of mine production, delaying waste/development and prioritising value without compromising the future of the operation.

4

Cut-off Grade

Based on “Net Value per Bottleneck Unit” not “grades”. Raising the cut-off grade above break-even on a dynamic basis can substantially increase economic value.

5

Stockpiles

Deferring rather than wasting lower value material. This mechanism prioritises value, provides operational flexibility and creates commercial options.

6

Blend

Controlling the range of certain characteristics for the plant feed or the product is a function of time and place. What are the operational or commercial penalties and rewards for hard vs soft blending limits?

7

Processing

Varying plant throughput will have a significant impact on recoveries and processing costs.

8

Product Mix & Specification

A range of products could be produced over time with a significant impact on recovery, transportation costs and product commercial terms.

9

Logistics

Adjusting capacity to pursue margin rather than cost minimisation. More costly logistics, used under the right circumstances, can produce increased overall value.

10

Capital

Capital decisions should not be made in isolation. With dozens of interrelated capital decisions, the matrix to explore can be substantial and the financial benefits significant.