THE MINING BUSINESS CHALLENGE

SEMAFO is a Canadian-based mining company with gold production and exploration activities in West Africa. The Corporation operates the Mana Mine in Burkina Faso.

SEMAFO’s strategic focus is to maximise shareholder value by effectively managing its existing assets, as well as pursuing organic and strategic growth opportunities.

The Mana operations included a pit in production, a pit to be developed, and the option for underground mining. The pit was multi-phase, with a mining rate of 20 Mt per annum, and a traditional crush/grind/CIL circuit was ultimately modelled at 7,200 tonnes per day, with a rate of 8,000 tpd in the softer ore. It was noted early on that the operation generated power onsite with diesel generators.

At the request of SEMAFO, Whittle Consulting was engaged to undertake a Whittle Enterprise Optimisation study on the SEMAFO Mana Gold asset.

THE WHITTLE CONSULTING SOLUTION

The first step involved Whittle Consulting working with SEMAFO Mana Gold personnel to define a base case from existing mine plans and financial models. Using actual costs and data from the feasibility study, a base case business model was created, and a Prober run that mimicked the current plan and NPV was produced. This model included a calibrated power model for the milling circuit.

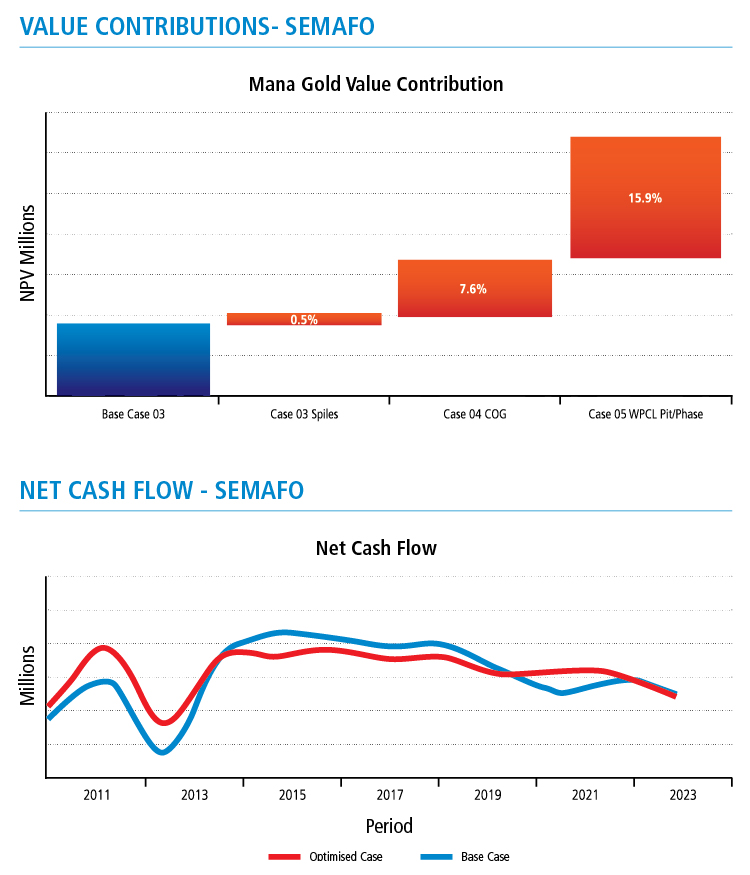

Whittle Consulting then generated an optimised business model which employed advanced analytical techniques and proprietary Whittle Enterprise Optimisation software. This model was used to simultaneously optimise the Whittle Consulting 10 Steps (i.e. pit, phases, scheduling, cut-off , blend, stockpiles, processing, product mix & specification, logistics and capital). From this exercise, an optimised study for SEMAFO Mana Gold was calculated. The results were an improvement in NPV of 24%

THE RESULTS

The results of the Whittle Consulting Enterprise Optimisation study for SEMAFO Mana Gold were financially significant. The study unified all available information into a single strategic business model, identifying important value opportunities. The Whittle Consulting Enterprise Optimisation model also provided a holistic view of the business and a valuable strategic tool for future business planning.

The Whittle Consulting Enterprise Optimisation study determined:

• Cut-off value and stockpiling added 8% to the operation’s NPV.

• Activity Based Costs and Theory of Constraints, using power as the bottleneck in the system, changed the pit shape and phasing and resulted in an additional 16% improvement in NPV.

• Grind-throughput-recovery was not available for this project, but would have added to the NPV uplift. It is likely that this would improve the NPV due to the power limitations of the site.

• Cash flow for the operation improved significantly.